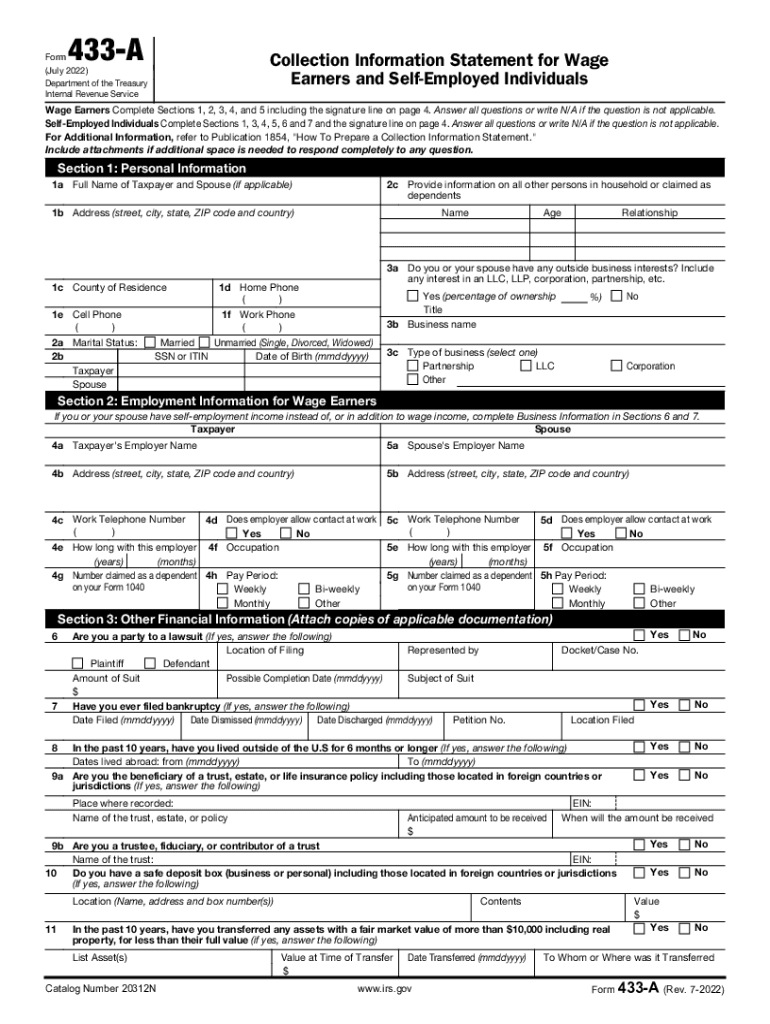

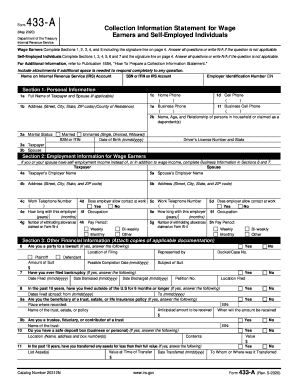

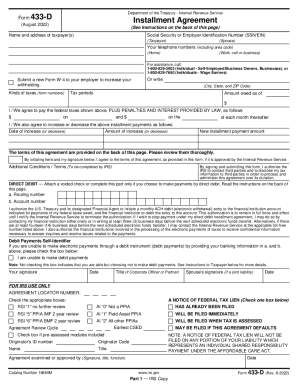

What is IRS Form 433-A used for?

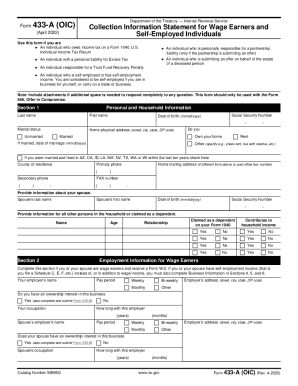

Form 433-A (formally named "Collection Information Statement for Wage Earners and Self-Employes Individuals") collects information about finances (including any debts and assets) used to decide how a wage earner or self-employed person can cover the owed tax liability.

Who should file Form 433-A 2024?

There are a few categories of people that should file IRS Form 433-A:

- Individuals who owe taxes on 1040

- A person that is personally responsible for a partnership liability

- Self-employed workers (independent contractors or sole proprietors)

- Individual owners of LLCs (limited liability companies) that are disregarded entities

- People accountable for a Trust Fund Recovery Penalty

What information do I need to file IRS Form 433-A?

Form 433 A requires the following information: personal information, employer (for wage earners), lawsuits, bankruptcies, trust beneficiaries, cash, bank deposits, investments, cryptocurrency, credits, real estate property, personal vehicles, assets, monthly incomes, monthly expenses, and businesses. Use the official Form 433 A instructions on the Internal Revenue Service website for more details.

How do I fill out IRS form 433-A in 2025?

Carefully review the six-page form and enter details for your monthly expenses and expected income. The Internal Revenue Service will use this information to determine how much you must pay each month as part of an installment plan.

You can find detailed instructions on how to fill out every section of this template on the Internal Revenue Service website. Remember that sections 1, 2, 3, 4, 5, and a signature line are for wage earners, and sections 1, 3, 4, 5, 6, 7, and a signature line are for self-employed individuals.

Simplify the filling process using online tools like pdfFiller:

- Click Get Form to open the template.

- Start filling out the document by inserting data into fillable fields.

- Go through all required sections.

- Sign and date the document.

- Add your spouse's signature if you are married.

- Select Done in the top right corner.

- Export the file in your preferred way: by downloading, mailing, or emailing it.

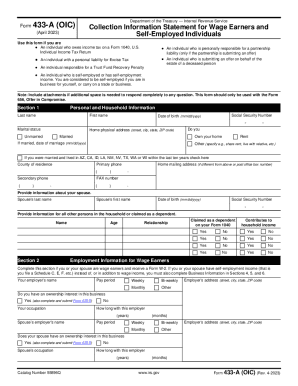

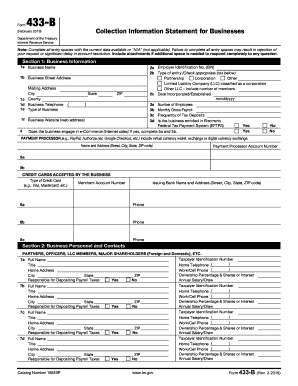

Is form 433 A accompanied by other forms?

You may need to complete other versions of the Collection Information Statement, such as Forms 433-F or 433-B. Also, you should attach supporting documentation that applies to your situation. For example, it can be a copy of a statement for each investment, pay stubs from employers, lender's balances or payoff amounts, etc. Otherwise, IRS officials will request evidence of expenses you report on in your financial statement. In this case, you will need to prepare checks, money orders, or other documents that verify your payments.

When is form 433-A due?

433-A is usually filled out upon request of the authorized person. If you received a request, you would find the due date in the letter. Otherwise, you may file this sample to the Internal Revenue Service whenever you want to apply for an extension of payment.

Where do I send IRS form 433-A?

There are two addresses where the Internal Revenue Service receives 433-A forms depending on your state: Memphis IRS Center COIC Unit, TN and Brookhaven IRS Center COIC Unit, NY. Check the list on the official website or simply file documents online.